K2 MULTIFAMILY INVESTORS LLC:

SELL YOUR APARTMENT COMPLEX

WE BUY 50+ UNIT B & C-CLASS APARTMENT COMPLEXES

WE BUY 50+ UNIT APARTMENT COMPLEXES IN THE SOUTHEASTERN AND SUNBELT STATES.

Ready To Sell Your C-Class or B-Class Multifamily Property?

Call Multifamily Investor Steve Kazella: 850-842-5900

Sell My Apartment Complex in:

Huntsville, AL

Tuscaloosa, AL

Atlanta, GA

Augusta, GA

Savannah, GA

Pooler, GA

Athens, GA

South Fulton, GA

Bluffton, SC

Charleston, SC

Columbia, SC

North Charleston, SC

Greenville, SC

Spartanburg, SC

Myrtle Beach, SC

Charlotte, NC

Raleigh, NC

Greensboro, NC

Durham, NC

Winston-Salem, NC

Cary, NC

Apex, NC

Gastonia, NC

Wilmington, NC

Leland, NC

High Point, NC

Dallas - Fort Worth, TX

Austin - Round Rock, TX

Georgetown, TX

San Antonio, TX

OUR SERVICES

Multifamily Acquisitions Specialists & Syndicators

K2 MULTIFAMILY INVESTORS LLC (K2MI) is a multifamily real estate investment and acquisition company headed up by vertical real estate and wireless infrastructure leasing expert Stephen Kazella. K2MI targets acquisitions of value-add mid-sized B & C-Class apartment complexes with 50+ doors.

We provide valuable acquisition services for multifamily property owners who are ready to sell, or who are in need to sell. We buy apartment complexes from owners directly - saving multifamily sellers time, money and frustration.

Our experienced team of multifamily investors, legal advisors and commercial real estate professionals have extensive local knowledge of the Southeastern multifamily housing market. We participate as a GP in all acquisitions with a solid real estate syndication model for our LPs. Ready to sell your apartment complex? Call Steve today: 850-842-5900

ACQUISITION CRITERIA

K2MI is targeting following types of multifamily properties which fit our acquisition and syndication model:

C & B Class apartment complex properties built between 1960 - 2015

Minimum acquisition requirement 50+ units

Targeting apartments complexes with 50 - 200 units

Seeking light value-add multifamily properties - no "war zones"

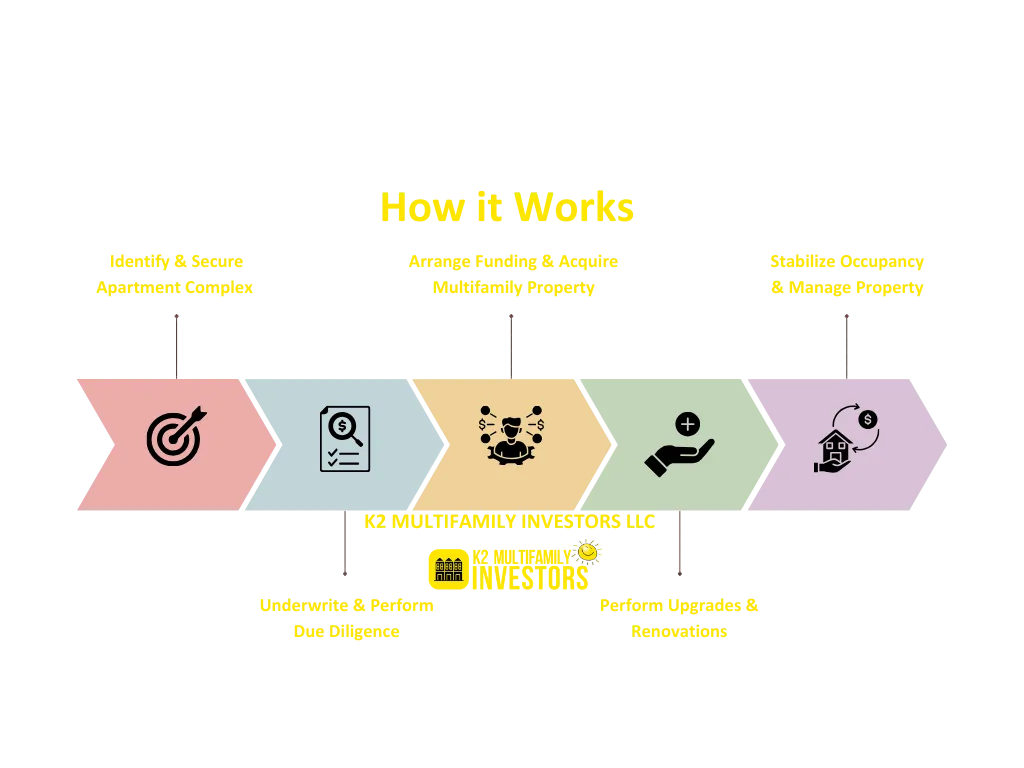

HOW IT WORKS

K2MI - Exceptional at Multifamily Property Acquisitions

We Buy Apartment Complexes: 850-842-5900

My name is Steve Kazella, if you have decided that it is time to sell your apartment building or sell a multifamily property, we can help you. I'd like to discuss purchasing it from you. The acquisition services that we offer allow apartment sellers to dispose of their multifamily properties quickly and efficiently, by selling directly to your buyer - me, without having to pay upwards of six figures in real estate commissions. Please let me know how K2MI can be of value to you.

My partner real estate investors and I are looking for multifamily properties that we can upgrade and improve to add value to and hold onto. We are looking for apartment buildings like yours, the small to medium-sized multifamily or apartment complexes that have a minimum of 50+ units, up to approximately 200 units. Call me: 850-842-5900.

Why Sell Multifamily Properties To Me?

Benefits of Selling Your Apartment Complex to Steve at K2MI.

Steve wants to buy your apartment complex.

Selling your apartment building to Steve and K2MI is about keeping things simple, efficient and stress-free. We save apartment complex sellers TIME, MONEY AND HEADACHES. Here’s what you get when you work with K2MI.

Zero Broker Commissions. You hold onto the commercial broker’s six-figure real estate commission.

Close Faster. With the help of our streamlined underwriting and multifamily syndication process, we can close faster saving you time and money. We have the resources and the ability to close multi-million dollar transactions quickly, discreetly and on your timeline.

Sell As-Is. You Can Sell Your Complex As-Is. We will buy your multifamily property as-is, ugly is okay, we can give your apartment complex the TLC it needs and we can also optimize any property management or tenant matters needing attention and remove the burden from your shoulders.

STEPHEN ("STEVE") KAZELLA - K2MI BIO

About Steve: Steve Kazella is the founder of K2 Multifamily Investors LLC (K2MI), a Pensacola, Florida multifamily real estate investment and syndication firm. Steve is a vertical real estate expert transitioning from nearly 20 years of cell tower and rooftop leasing landlord advocacy into the multi asset class, he has consulted on over 2,000 wireless telecommunications lease transactions for owners and landlords on lease and easement sale negotiations with Verizon, T- Mobile, AT&T and publicly traded REITs. He is a 1993 Montclair State University (N.J.) graduate (B.S.), cell tower landlord advocate - and purpose-driven multifamily investor.

Multifamily Investor: K2MI focuses on delivering value to limited partners and quality housing for tenants. Steve's partnered with a Dallas-Fort Worth multifamily investor who is a General Partner on over 1,000 apartment units and is working with a top-tier acquisition, underwriting and legal team along with a close network of purposeful multifamily investors owning thousands of U.S. apartment units.

Cell Tower Industry Leader: Founding Partner at Tower Genius, a top U.S. wireless leasing consultant. Featured in the New York Times, in Christianity Today and Realtor Magazine. Since 2000, worked with Sprint, T-Mobile, Verizon, and advised Wall Street banks, utilities. Since 1990s, Tower Genius partners have overseen 10,000 negotiations exceeding $11.5 Billion in leased value. Supported FEMA and Verizon immediately post-9/11 with 36 emergency Cell on Wheels (COWs) deployments in NYC.

Core Value Driven: Honesty and Integrity are the foundation of Every Apartment Complex Acquisition. The driving force behind Steve's career is the above-mentioned quote from friend and former colleague, Millard Fuller. It has motivated Steve in his wireless consulting work throughout his career, and is his core belief in his multifamily acquisitions endeavors.

Global Housing Advocate: Early in his career, Steve Partnered with President Jimmy Carter and Habitat for Humanity’s CEO Millard Fuller to launch Hungary’s first Habitat affiliate. He spearheaded the 1996 Carter Project "Blitz Build" in Vác, Hungary, building 10 homes in 7 days with 500 volunteers.

Local Vision: Still, some of the most exciting and impactful times of Steve's career were sitting in conference rooms in 1995 in small-town Americus, Georgia with Millard Fuller, President Carter and other Habitat Executives, as a 26-year old giving insights and recommendations to Habitat leadership and a former U.S. President on the day to day operations in Hungary, planning of the upcoming international build project and special event, and laying out future plans for the newly-formed Hungarian Habitat affiliate after the 500 American volunteers returned to the United States.

Global Impact: Twenty-nine years later, Habitat is thriving in Hungary. Since the 1996 Jimmy Carter Project in Vác, HFHI Hungary has built over 150 homes, renovated nearly 800 dwellings, offered technical counseling to 700 families, and provided household management and training programs to 1,100 people, impacting 2,700 families overall.

Need To Sell An Apartment Complex?

We Buy Multifamily Properties

Call Steve 24/7: 850-842-5900

Your "We Buy Apartments" Expert

K2MI - Multifamily Investor & Multifamily Syndicator buys 50+ unit B/C-Class Apartment Complexes in the Southeast, including Northwest Florida, Georgia, Alabama, South Carolina, North Carolina, Tennessee, and Texas.

Have you decided that you are ready to sell your multifamily property or apartment complex? We buy apartment complexes in Dallas TX, Fort Worth, TX, Irving TX, Grand Prairie TX, Arlington, TX, McKinney TX, Garland TX, Mesquite TX, Richardson TX, Frisco, TX, Lewisville TX, Richardson TX, Denton TX, Austin TX, San Antonio TX, Houston TX, Florence AL, Muscle Shoals AL, Huntsville AL, Tuscaloosa AL, Brunswick GA, Savannah GA, Pooler GA, Atlanta GA, McDonough GA, Conyers GA, Lawrenceville GA, Alpharetta GA, Roswell GA, Kennesaw GA, Marietta GA, Smyrna GA, Athens GA, Augusta GA, Asheville NC, Raleigh NC, Durham NC, Leland NC, Wilmington NC, Charlotte NC, Greensboro NC, Winston-Salem NC, Bluffton SC, Charleston SC, Columbia SC, Myrtle Beach SC, Greenville SC, Pensacola FL, Boca Raton, FL. Ready to sell your C-Class or B-Class Apartment complex and skip the broker commission? Call multifamily apartment complex investor Steve Kazella 850-842-5900.

GET AN OFFER FROM STEVE

ON YOUR APARTMENT COMPLEX

Shipping Address:

K2 MULTIFAMILY INVESTORS LLC

Stephen Kazella, Managing Partner

4771 Bayou Blvd. #228

Pensacola, Florida 32503

Let's Talk!

Call Steve at K2:

850-842-5900

Privacy Policy - Terms of Use

Call 850-842-5900